पैन कार्ड से आधार लिंक कैसे करे बेहद सरल घर बैठे | aadhar card ko pan card se link kaise karen status check

पैन कार्ड से आधार लिंक समय सीमा जुर्माना

income Tex department website link

Table of Content :

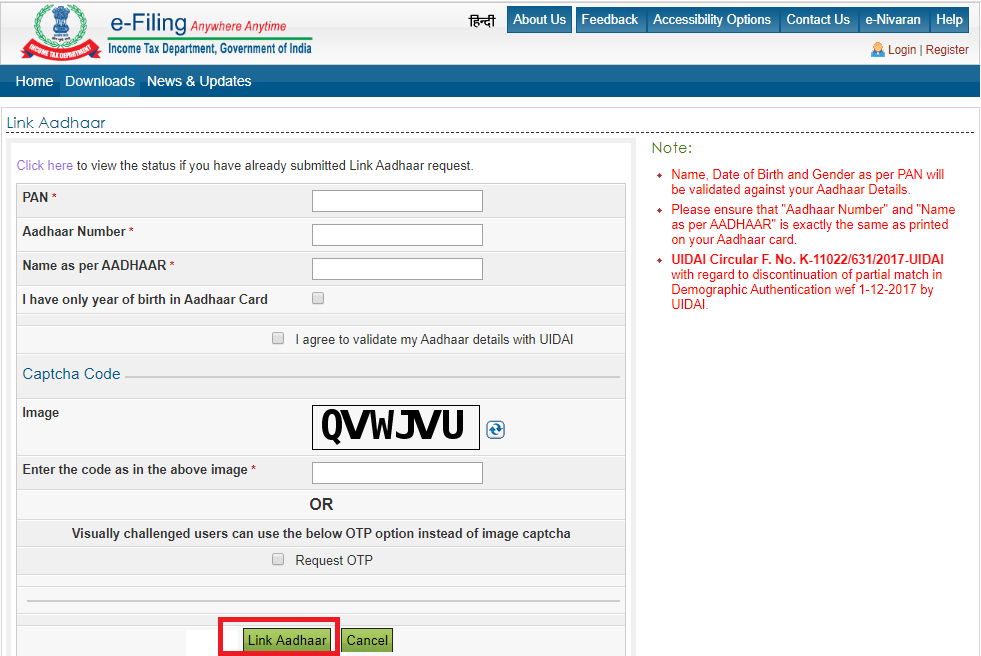

How to Link PAN Card to Aadhaar Card Online through e-Filing Website

People can get their PAN and Aadhar linked online by following the steps mentioned below:

Step 1. Step 1. Visit the Income Tax e-Filing website and click on the ‘Link Aadhaar’ option under the quick links

Step 2. Enter your PAN and Aadhaar number

Step 3. Enter the name as mentioned in your Aadhaar card

Step 4. In case, if only the date of birth is mentioned on your Aadhaar card and you have to tick the square

Step 5. Tick mark ‘I agree to validate my Aadhaar details with UIDAI’

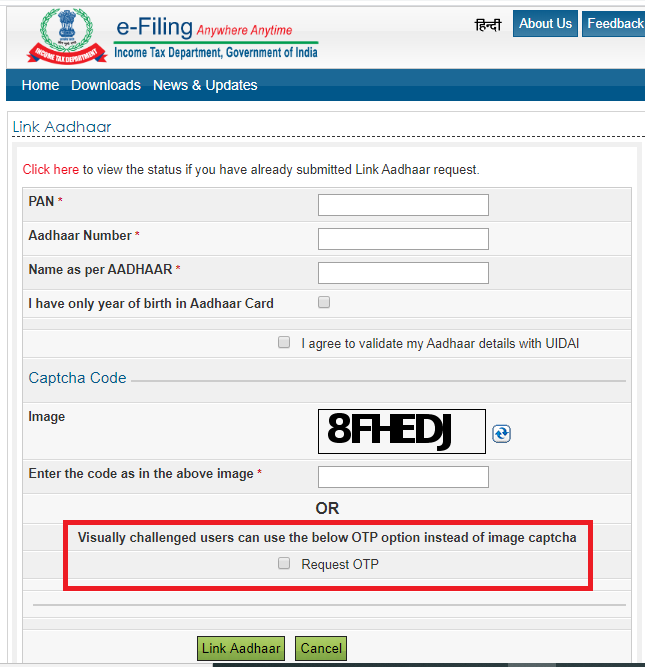

Step 6. Now, enter the ‘Captcha Code’ mentioned in the image for the verification

Step 7. You need to click on the ‘Link Aadhaar’ button

Step 8. A pop-up message will appear showing your successfully linked Aadhaar with PAN Card

Note: Visually challenged users can request for an OTP that will be sent to the registered mobile number instead of the captcha code.

How to Link Aadhaar with PAN by sending an SMS

In order to link your Aadhaar to PAN, follow these steps:

- You have to type a message in the format

UIDPAN<12 Digit Aadhaar> <10 Digit PAN> - Send the message in the above-mentioned format to either 567678 or 56161 from your registered mobile number

- For example, if your Aadhaar number is 987654321012 and your PAN is ABCDE1234F, you have to type UIDPAN 987654321012 ABCDE1234F and send the message to either 567678 or 56161

Correction Facility for Linking your PAN with Aadhar Card

PAN and Aadhar card linking is successful only when all your details in both documents match. In case there are errors such as spelling mistakes in your name, your PAN will not be linked with Aadhaar. You can make changes by visiting a nearby Aadhaar Enrolment Centre or through the portal of NSDL PAN. In case there are errors, you can get them corrected by following these steps:

- The user can correct his PAN details using the NSDL website

- The NSDL link redirects to the page where you can apply for the correction of your name

- Submit signed digital documents to get your PAN details updated

- Once your details are corrected in your PAN and confirmed by NSDL over a mail, you can link your PAN with Aadhaar

Unable to Link PAN with Aadhaar? Here’s What to Do

The Government of India has made it mandatory for all individuals to link PAN card with Aadhaar card before the deadline (i.e.31st March 2021) as failure to link the both will lead to deactivation of PAN by the Income Tax Department and you will not be to file Income Tax Returns, etc.

Moreover, make sure your name should be the same on both the PAN card and the Aadhaar card. In case there is some spelling mismatch, you will be unable to link Aadhaar with PAN. You will have to get your name corrected and after correction, you will be able to easily link your PAN with Aadhaar.

In case your name in the PAN card is wrongly spelt, follow these steps to make corrections:

Step 1: Visit the e-filing website of NSDL at https://goo.gl/zvt8eV

Step 2: Select the ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’ option from the drop-down menu

Step 3: Select the individual category and enter your details

Step 4: Make payment and submit your form online after Aadhaar e-KYC

Step 5: Your updated PAN will be sent to your address

Step 6: Once you receive your PAN card, you can link your PAN with Aadhaar

In case your name in the Aadhaar card is wrongly spelt, follow these steps to make corrections:

Step 1: Visit an Aadhaar Enrolment Centre

Step 2: Carry a self-attested copy of your proof of Identity

Step 3: Fill the Aadhaar Enrolment Form

Step 4: Submit the form along with the documents

Step 5: You will get an acknowledgement slip that contains the update request number

Step 6: This URN can be used to check the status of your update request

Step 7: Once your update request is processed and the name is corrected, you can link your PAN with Aadhaar

Importance of Linking PAN Card with Aadhar Card

Linking PAN with Aadhar is very important for all PAN cardholders because of the following reasons:

- All PAN cards that are not linked with Aadhaar will be deactivated after March 31st, 2020

- Linking PAN with Aadhaar will help in tackling the problem of multiple PAN cards issued in the same name

- Your income tax return form would not be processed if your PAN is not linked with Aadhaar

- The user will get a summarised detail of taxes levied on him for future reference

How to Check if my PAN Card is Linked with Aadhaar Card or not

To check PAN-Aadhaar link status, follow the steps mentioned below:

Visit the e-Filing Income Tax Department or check

0 Response to "पैन कार्ड से आधार लिंक कैसे करे बेहद सरल घर बैठे | aadhar card ko pan card se link kaise karen status check"

Post a Comment

Thanks for your valuable feedback.... We will review wait 1 to 2 week 🙏✅